operating cash flow ratio ideal

We usually have somewhere between 15x and 2x. Net Leverage Ratio Net Debt - Cash Holdings EBITDA.

Cash Flow Per Share Formula Example How To Calculate

A higher liquidity ratio represents that the company is highly rich in cash.

. Download it here - the Excel webservice function only works on Excel for Windows. The ratio states net. All the best for your investing journey.

Capital employed Total of fixed assets Working capital. In the next year ie. In corporate finance the Debt-Service Coverage Ratio DSCR is a measure of the cash flow available to pay current debt obligations.

An increase in interest rates when you have conservative leverage is not really going to move the needle on the companys cash flow coverage. It gives the exact amount of cash earned. This is one of the most important models as it serves as a base for other complex models such as the Leveraged Buyout LBO Model or the Discounted Cash Flow DCF Model.

Your competitors and your business operate in similar environments. Cash on cash return cap rate and net annual. Quite unsurprisingly as a gas producer they have seen their cash flow performance fluctuate across the years with their operating cash flow ranging from a low of 7356m during 2020 as the Covid.

A short summary of this paper. Operating expenses do not include mortgage principal or interest. Operating profit ratio 1 operating ratio.

Full PDF Package Download Full PDF Package. Calculate your short term rental cash flow cap rate and cash on cash return with this short term rental cash flow calculator. How To Calculate Taxes in Operating Cash Flow.

It is one of the important earnings per share ratio variations as it helps understand the companys financial standing. Its calculated using the following formula. Solvency ratio is also known as leverage ratio.

Thus an ideal capital structure is one that provides enough cushions to shareholders so that they can leverage the debt-holders funds but it should also provide surety to debt holders of the return of their principal and interest. For instance banks have low operating expense ratios sometimes as little as 0. A ratio of 11 is considered ideal.

Similarly current account savings account CASA ratio of bank grew 270 basis points year-on-year to 42 during the September quarter. Operating expense ratios can vary by industry. It offers an at-a-glance look at the value of a business relative to its debts.

It uses the numbers from the companys historical financial. To get this to work you must enter your token in column B1. Your companys ideal return on sales ratio depends on a few factors.

For most industrial companies 15 may be an acceptable current ratio. Bank Efficiency Ratio 1070000 2200000. 4 Full PDFs related to this paper.

Hope it will help. The current ratio is the ratio between the current assets and current liabilities of a company. Net profit ratio is calculated by dividing net profit after interest and tax by net sales.

FY2006 the cash flow statement in the cash flow from financing section will contain the outflow for the final dividend of FY2005 which is paid after AGM in FY2006 and the outflow for any interim dividend for FY2006 which is declared and paid within FY2006. There are many metrics that can be used to analyze whether a particular property will be an ideal short term rental investment. A higher OCF signifies a good liquidity position of the company.

There is no defined ideal ratio. The best ratio to evaluate short-term liquidity is liquid ratio. The three key evaluation metrics are.

Bank Efficiency Ratio 486 Bank Efficiency Ratio Formula Example 2. The types of liquidity ratios are. We would like to show you a description here but the site wont allow us.

Operating Cash Flow OCF. Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease. The other 50 can be used to pay the monthly mortgage payment.

Let us take another example of the same Bank A who has recently started and they want to identify the efficiency ratio of the bank to analyze how well the company is using its resources to generate revenue. Operating Expense Ratio Operating Costs Total Revenues. Your labor and material prices and costs are similar.

However an investor should also take note of a companys operating cash flow in order to get a better sense of its liquidity. Current assets are assets that a company plans to use over the same period. Examples of current liabilities are accounts payable short-term loans payroll.

For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk attached to an investment property or business. An ideal efficiency ratio is 50 or less which means that the bank generates 2 or more for every 1 it spends. This can be used to quickly estimate the cash flow and profit of an investment.

Debt-Service Coverage Ratio DSCR. A three-statement model is a dynamically integrated financial model developed by linking together a companys three primary statements. A STUDY ON RATIO ANALYSIS AT AMARARAJA BATTERIES LIMITED ARBL A PROJECT REPORT MASTER OF BUSINESS ADMINISTRATION Under the Guidance of.

Low values for the current ratio values less than 1 indicate that a firm may have difficulty meeting current obligations. Net cash flow Net Cash Flow Net cash flow refers to the difference in cash inflows and outflows generated or lost over the. For this reason many investors feel that it is not a true measure of the operating cash flow and overall financial health.

Cash earnings per share ratio Operating Cash FlowDiluted Shares Outstanding 5. Free Cash Flow to Operating Cash Flow. IEX Cloud provides an example Excel file that can be used to see how the web service function works.

And unlike net income it is difficult to play around with this variation of earnings per share ratio. 50 RuleA rental propertys sum of operating expenses hovers around 50 of income. Operating Cash Flow to Sales Ratio.

Others like the building materials industry have OERs as high as 73. This type of ratio helps in measuring the ability of a company to take care of its short-term debt obligations. Current liabilities are debts that are due within one year or one operating cycle.

Please note the highlighted column for latestUpdate is a formula that converts the Unix timestamp into an Excel datetime. Financial management standards help a not-for-profit monitor its budget cash flow resource utilization and revenue sources. Based on our example above we would come up with.

This articles focus is on the use of financial ratios in trend analysis and benchmarking to improve the effectiveness of management and boards charged with monitoring not-for-profit organizations specifically those. Private lender HDFC Bank disclosed that its advances in September quarter grew 16 and deposits rose at 20 year-on-year. It is money generated by a companys primary business operation.

However most banks efficiency ratios are higher than that. Debt-to-equity ratio measures the ratio of a business total liabilities to its stockholders equity.

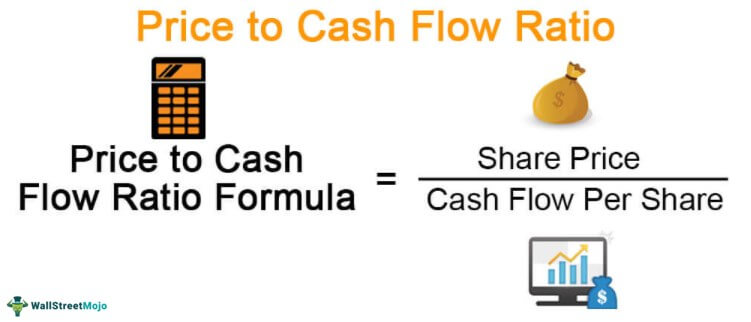

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

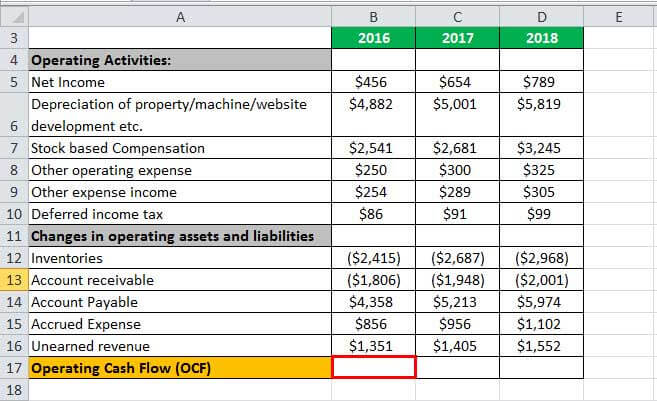

Operating Cash Flow Formula Calculation With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Definition Formula Example

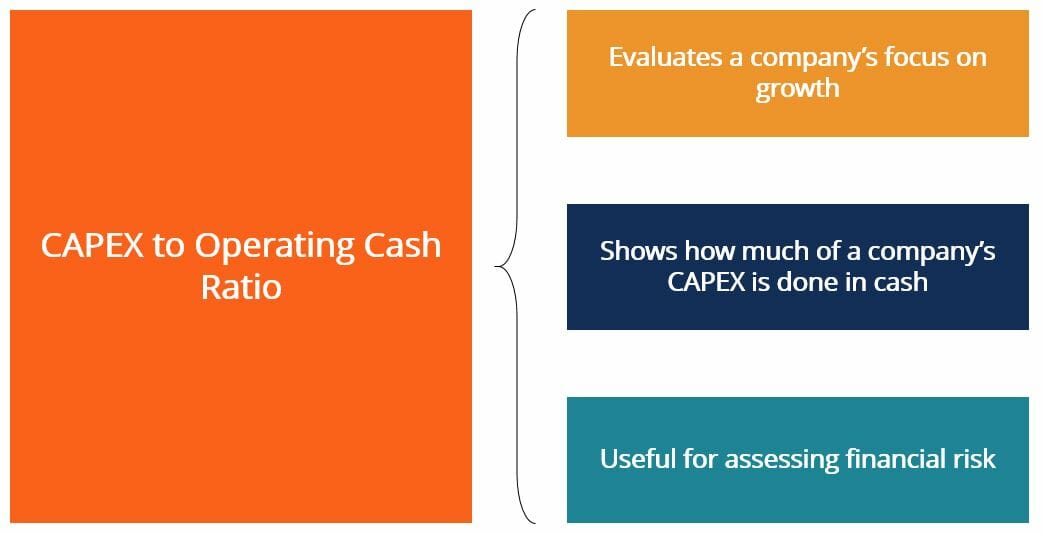

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Ratio Calculator

Operating Cash Flow Formula Calculation With Examples

Cash Flow Ratios Calculator Double Entry Bookkeeping

Free Cash Flow Operating Cash Ratio Free Cash Cash Flow Flow

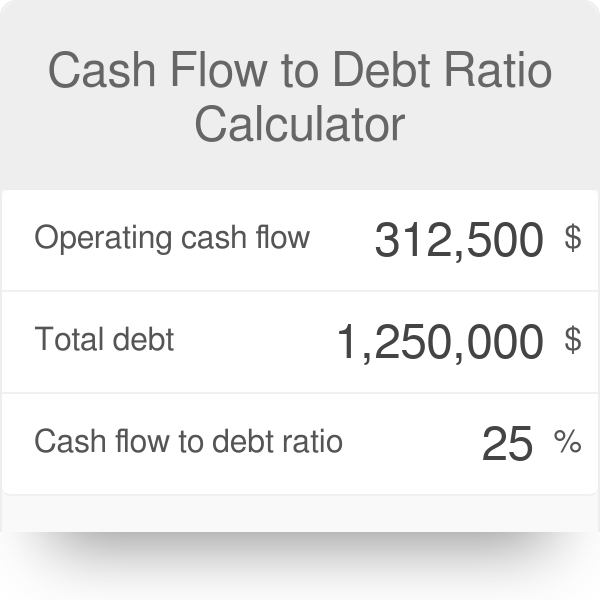

Cash Flow To Debt Ratio Calculator

Cash Flow From Operations Ratio Formula Examples

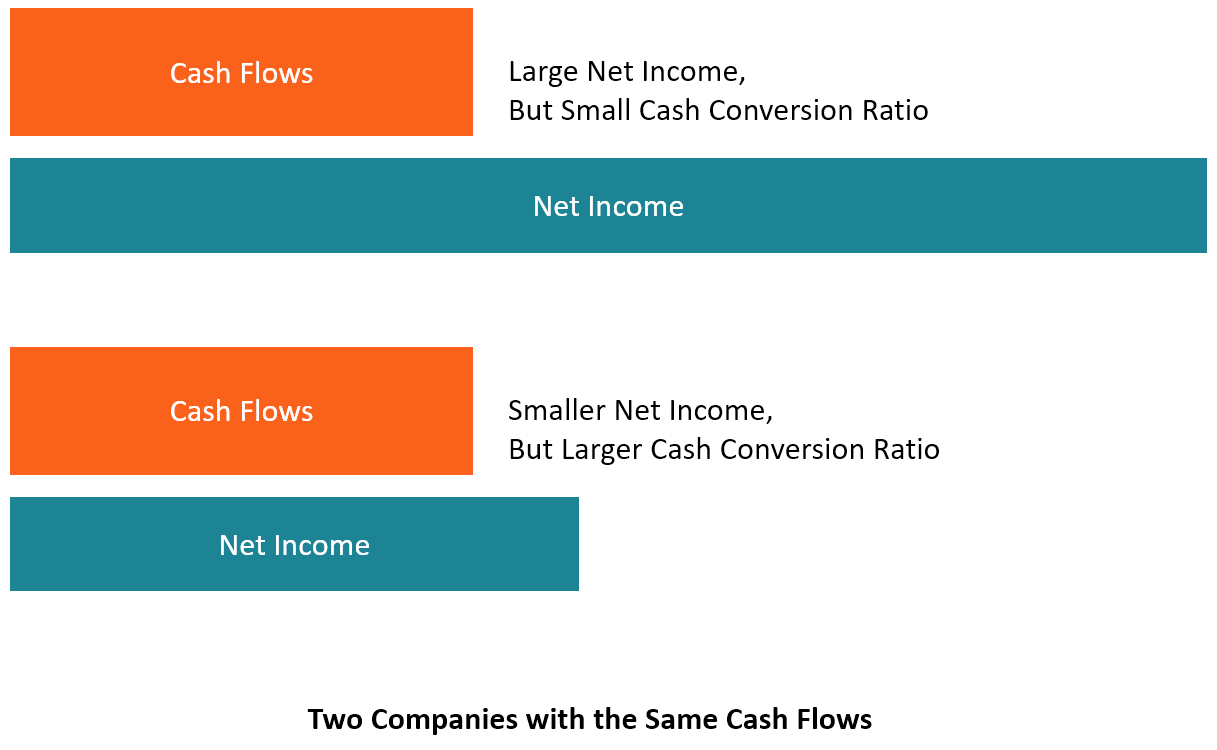

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Operating Cash Flow Ratio Formula Guide For Financial Analysts